Tax Rules - Setting Up Taxes

Last Updated: December 4, 2025

Link to Feature: https://app.fireflyreservations.com/taxes (or click here)

Quick Links:

Overview

Each unit is able to have custom tax rules so you may apply different taxes to your unique unit types like RV, Lodging, Storage, or Boat Slip units as needed. You are also able to set up tax rules based on length of stays. For example, you can apply local tax to all reservations with a hotel tax on Cabin reservations less than 30 days and sales tax on RV reservations less than 30 days, and you can still have other units not taxed at all. This is all possible in Firefly!

IMPORTANT: Firefly does not file or remit taxes on behalf of your property.

Firefly simply calculates and collects tax amounts as configured in the system's settings. If you use integrated payment processing to accept card or bank transfer payments through Firefly then all funds, including collected taxes, are processed by your payment processor and deposited into the bank account associated with your processor's merchant account.

To our knowledge, payment processors also do not remit taxes on behalf of merchants.

You are responsible for determining, reporting, and remitting your property's applicable taxes directly to the appropriate local, state/provincial, or federal tax agencies. Since tax requirements vary by location and business type, we strongly recommend reaching out to your tax authorities to confirm your applicable tax rates, required documentation, as well as filing and remittance schedules.

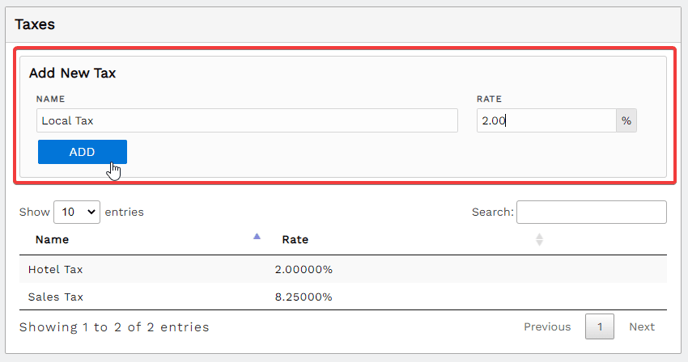

Set Up Taxes

To apply taxes in Firefly you first need to set up your tax names and rates. From the main menu, click on Settings > Taxes to view all your current taxes. To add a tax, just enter the name of the tax and the rate and click Add.

Screenshot of process to add new tax under Settings > Taxes

Screenshot of process to add new tax under Settings > Taxes

Once you have added all your possible taxes, you are ready to set up the taxes for each unit.

Apply Taxes to Units

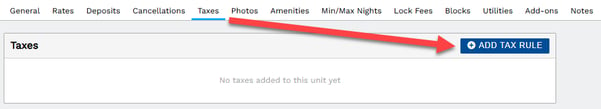

Once tax rates are set in the system, you must create rules to apply the taxes to unit charges.

To apply a tax to a reservation's unit charges:

- Go to Settings > Units > select a unit to open it > Taxes tab > Add Tax Rule.

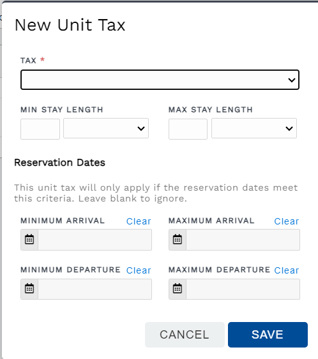

- Select the tax you want to add to this unit and enter other settings as needed to indicate when the tax should be applied. For example, if you only want a tax to be applied when the reservation is 30 days long or less you will set the Max Stay Length to 30 days.

- Click Save once you have addressed all necessary setup fields.

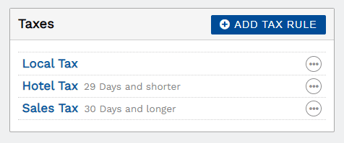

- You will now see all your tax rules listed for that unit.

- If you want to copy these same tax rules to any other units, you can export the tax rules using the import/export unit info feature.

Apply Taxes to Point of Sale

Taxes may be applied to Point of Sale items through a POS Item Category or on an individual item. Check out this article for more information on setting up taxes in your POS: Point of Sale

Override Taxes on a Charge

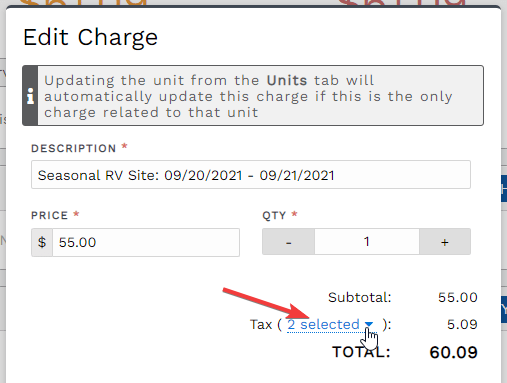

If you ever need to modify taxes applied to a specific charge, you can manually edit taxes from the Edit Charge dialogue box. Simply navigate to a reservation's Charges tab, click the 3 dots on a charge to open its Options menu and select Edit.

Screenshot showing tax dropdown in the Edit Charge window.

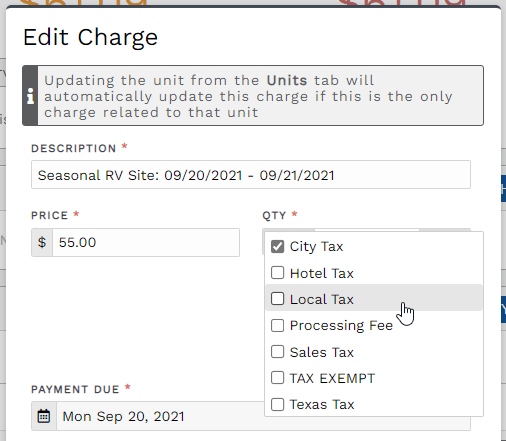

Screenshot showing tax dropdown in the Edit Charge window.Next, select or deselect the taxes' checkboxes as needed.

Screenshot of Edit Charge dialogue box and the list of taxes associated with the charge.

Screenshot of Edit Charge dialogue box and the list of taxes associated with the charge. After you have ensured taxes are applied as desired, click out of the taxes dropdown to close the list of taxes. The charge's taxes total is automatically recalculated to include only the taxes you just selected. Click Save on the charge, and the charge will the saved with the new taxes!

Edit an Established Tax

Once a tax has been established, it cannot be modified. If you need to change the rate for an existing tax, you will create a new tax at the new rate then apply the new tax throughout the system to replace the old tax. If desired, you may delete the previous tax once it is no longer applied to any items in Firefly.

TIP: Check out this article for an all-in-one walkthrough: How to Change a Tax Rate.

Delete an Established Tax

To delete an existing tax from the system, it must fist be removed or replaced on all items it has been applied to. Then, from the main menu, go to Settings > Taxes and click the tax to open it. In the lower right corner of the taxes settings, you will see a red delete button.

How are taxes calculated in Firefly?

Tax amounts are rounded at the line-item level. In this case, the total tax value is calculated by applying the tax rate to each item in the order, rounding the result, and then adding these item subtotals together to arrive at the total value of the order.

Rounding taxes at the line level improves the calculation of different tax rates and makes it easier to calculate taxes for orders that include taxable and non-taxable products.

Tax Reports

Firefly offers 3 reports useful for gathering tax related data from the system:

- Journal Entries Summary

- Journal Entries Report

- Taxes Collected

More details for each of these reports is shared below. To access Firefly's Reports page, click Reports at the bottom of the main menu. To learn more about optimizing your use of Firefly reports, check out this article: Running Reports.

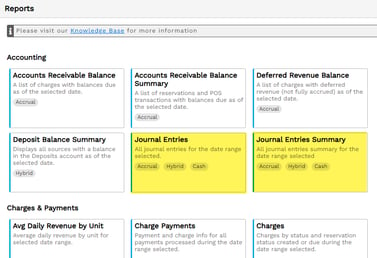

Journal Entries Summary & Journal Entries

TIP: We highly recommend the Journal Entries Summary report for preparing or filing estimated payments or tax returns to applicable tax authorities.

In the Accounting section on Firefly's Reports page, you will find the Journal Entries Summary and the Journal Entries reports.

You may configure your property's accounting setup to include unique General Ledger accounts for each tax authority, as well as specific income accounts as needed to track revenue for tax remittance purposes. For example, you may have accounts for city, county, and state taxes as well as accounts for transient or long term unit rates, categories for retail sales, and individual add-ons or fees.

You may then run the End of Day procedure to populate figures for the Journal Entries Summary report, and the associated Journal Entries report. The Journal Entries report just provides the line item breakdown of activity in each account. Both reports share the debits, credits, and post sum amounts for each General Ledger account. Allowing you to efficiently gather the details for revenue and all taxes collected during specified date ranges.

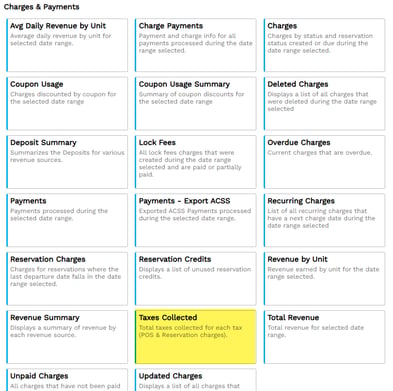

Taxes Collected

CAUTION: This report shares fully paid POS transactions and reservation charges only. We do not recommend the Taxes Collected report for preparing or filing estimated payments or tax returns to applicable tax authorities.

In the Charges & Payments section on Firefly's Reports page, you will find the Taxes Collected report.

The Taxes Collected report only includes POS Transactions and reservation charges that are PAID IN FULL during the date range specified.

NOTE: Firefly does not file or remit taxes on behalf of your property.

Firefly simply calculates and collects tax amounts as configured in the system's settings. If you use integrated payment processing to accept card or bank transfer payments through Firefly then these funds, including collected taxes, are processed by your payment processor and deposited into the bank account associated with your processor's merchant account.

To our knowledge, payment processors also do not remit taxes on behalf of merchants.

You are responsible for determining, reporting, and remitting your property's applicable taxes directly to the appropriate local, state/provincial, or federal tax agencies. Since tax requirements vary by location and business type, we strongly recommend reaching out to your tax authorities to confirm your applicable tax rates, required documentation, as well as filing and remittance schedules.

🙋♀️ Still need help? Email: support@fireflyreservations.com and one of our technicians can help answer your questions.

💭 We would love to know if this article was helpful in addressing your issue. If you could answer the question below it will notify our team. Thank you!

![Firefly-logo-high-res.png]](https://fireflyreservations.com/hs-fs/hubfs/Firefly-logo-high-res.png?height=50&name=Firefly-logo-high-res.png)